Financial Performance

Grupo Lamosa’s 2021 year-end operating and financial results were outstanding, reflecting the consistent and successful organic and inorganic growth strategy the company has implemented in recent years.

For the first time in its history, Grupo Lamosa became a company with revenues of more than a billion dollars, closing the year with extraordinary growth figures and enhanced profit margins, despite the increased cost of its main inputs.

During the year, based on Grupo Lamosa’s favorable performance, HR Ratings upgraded the company’s risk rating from “HRAA” to “HRAA+” on a local scale. Increased revenue, greater free cash flow generation and a reduced debt leverage ratio were just some of the factors taken into consideration for this progress.

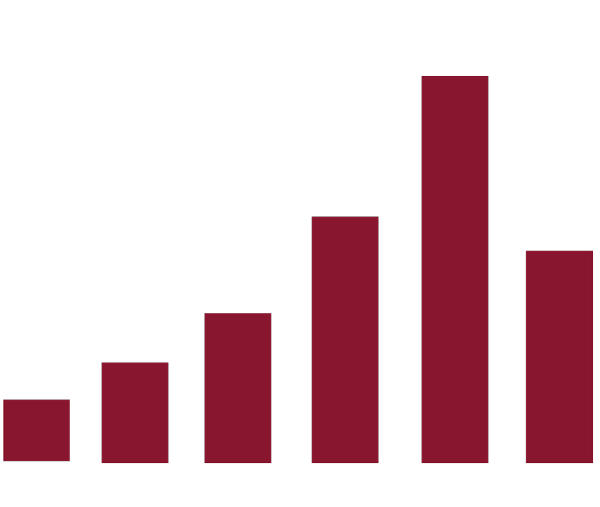

Moreover, the improvement in results and enhanced capacity to generate cash flow contributed to the capital expenditures of $635 million pesos made during the year and to partially financing the US$241-million acquisition of Grupo Roca’s tile business, without impacting the company’s leverage level. Grupo Lamosa’s Net Debt at the end of the year was $7,311 million pesos, with a Net Debt to EBITDA ratio of 1.0 times, below the ratio of 1.1 times posted as of year-end 2020.

One of the achievements of 2021 was the outstanding yield of the LAMOSA single series stock, the price of which grew 202% annually, reflecting the company’s extraordinary performance during the year.

In order to enhance Grupo Lamosa’s stock liquidity, the company made transactions through its Repurchase Fund, acquiring 11,594,709 shares representing its capital stock during the year, to end 2021 with a balance of 27,911,125 shares in the Treasury.

NET DEBT

Millions of pesos

![]() Net Debt / EBITDA

Net Debt / EBITDA

DEBT PROFILE

DEC. 2021