TILE BUSINESS

In 2023, the COVID pandemic, which had generated an extraordinary demand bubble during 2021 and 2022 that the business successfully leveraged, was a thing of the past, and demand in the global tile industry returned to normal.

The complex business environment during the year, with many atypical variables, represented a challenge for the Tile Business. The new reality was reflected in lower demand and results comparatively lower than the previous year, a situation that occurred to a greater or lesser extent across all the countries where the business operates.

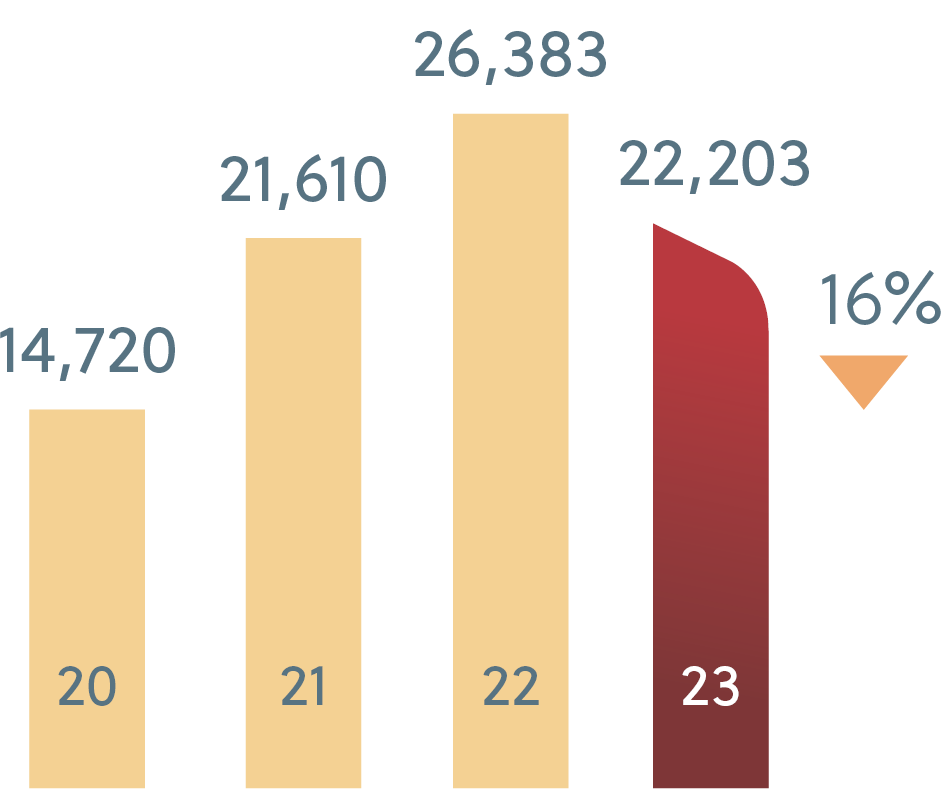

The Tile Business’s total 2023 sales were $22,203 million pesos, 16% below the previous year.

In 2023, the Tile Business continued its growth and expansion strategy with the acquisition of Baldocer, a leading Spanish manufacturer of high-end ceramic products that offers widely-recognized brands and a solid presence in more than 120 countries.

The acquisition of Baldocer positions the business as one of Spain’s main producers of ceramic tiles, consolidates its presence in Europe and extends its reach to countries in the Middle East and North Africa, expanding the horizon of the business’s operations and creating a solid platform for continued growth.

Net Sales

Millions of Mexican pesos

During the year, the Tile Business held the seventh edition of the Firenze Entremuros Award, recognizing the best in architecture and interior design in Mexico. It also participated in fairs and exhibitions inside and outside Mexico, launching new avant-garde product lines in accordance with market trends.

In recent years, the Tile Business has made significant capital expenditures in all the countries where it operates, mainly aimed at growing capacity and technologically upgrading its plants. These investments position the company better to continue capitalizing on synergies and opportunities in its diverse markets.

Market trends continue to focus on the manufacture of thinner products with larger formats, while complying with all corresponding international standards and without compromising functional properties. The investments and acquisitions that Grupo Lamosa has made position the business to leverage this trend, offering products that also have notable advantages from a sustainability perspective, since they use less energy in the manufacturing process and imply lower transportation costs.

ADHESIVES BUSINESS

During 2023, the Adhesives Business outperformed the industry, which faced a challenging environment, principally because of lower demand, with the reallocation of families’ disposable income to recreational activities significantly affecting home remodeling, but also due to a generalized increase in the cost of construction materials.

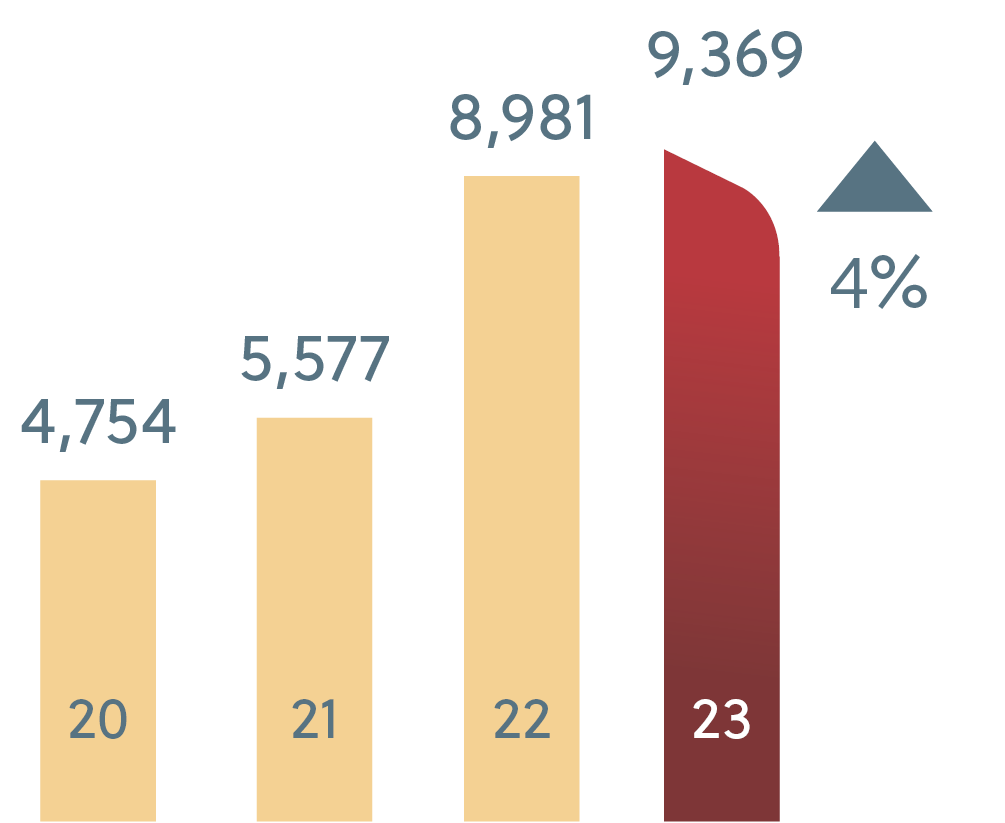

Sales for the Adhesives Business amounted to $9,369 million pesos, a growth of 4% year-over-year. The favorable performance of the business was reflected in a significant increase in business profitability.

Throughout the year, the Adhesives Business continued to implement programs aimed at promoting its products and rewarding installer loyalty. Crest CDMX Installer Day was celebrated in Mexico City, as well as Installer Day in Monterrey, with over 1,800 participants. Training sessions were also held in various cities across the country for over 1,500 installers.

Net Sales

Millions of Mexican pesos

One of the significant events in 2023 was the commencement of the investment in a new Fanosa

plant in Rosarito, Baja California. This capital expenditure will duplicate export capacity, to strengthening the business’s presence in the US market.

The operation of the Adhesives Business in Chile continued to progress significantly, with an increase in operational volume and the addition of new clients, which will further drive market share in the country.

In 2023, new product development focused on launching and promoting specialized offerings with greater added value. Examples include Niasa’s Oximuro, a stucco that captures CO2 emissions, and high-performance grouts, which have been well received by the market. Additionally, specialized products, such as Crest Blue Fence, an acrylic membrane for waterproofing and crack insulation in surface preparation prior to ceramic tile installation, were developed.

The Adhesives Business will continue to leverage the advantages provided by the quality and high performance of its products, offering the market a comprehensive portfolio of high-value solutions for the benefit of construction professionals.

FINANCIAL PERFORMANCE

Grupo Lamosa maintained a healthy financial structure throughout 2023, thereby supporting its growth and diversification strategy. During the year, the company’s effective financial management and cash flow generating capacity enabled significant capital expenditures and the continuation of its investment plan, primarily aimed at technologically upgrading all plants.

One of the most significant investments of 2023 was undoubtedly the acquisition of the Spanish ceramic company Baldocer during the fourth quarter of the year. This acquisition is being made through an initial payment of €354 million euros in 2023, mostly financed by debt, and a second payment scheduled for 2025 for not less than €71 million euros, an amount that could vary on the basis of its results.

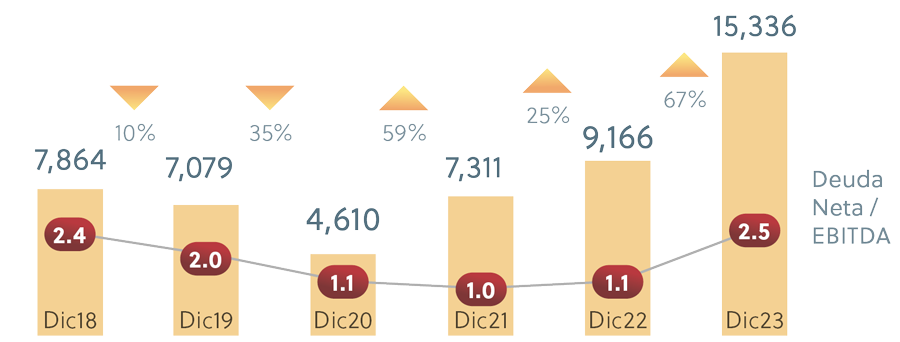

During the year, Grupo Lamosa made capital expenditures of $8,950 million pesos, including the initial partial payment of €354 million euros for the purchase of Baldocer. It is important to note that, despite these capital expenditures for one of the most significant amounts in recent years, Grupo Lamosa continued to maintain acceptable leverage ratios and in no way compromised its risk level. Net debt to EBITDA at the end of the year was 2.5 times.

Grupo Lamosa’s responsible financial performance was once again reflected in 2023 with the updating of the risk ratings assigned by HR Ratings and Fitch Ratings following the acquisition of Baldocer. These rating agencies, after revising their ratings upwards in 2022, maintained them throughout the year and assigned the company a stable outlook, both locally and globally.

In order to continue supporting the liquidity and tradability of the Lamosa* (single series) share on the Mexican Stock Exchange, Grupo Lamosa continued to operate its Repurchase Fund in 2023. During the year, the company acquired a total of 6,687,244 shares representing its capital stock, ending the year with a balance of 40,208,433 treasury shares.

Net Debt

Millions of Mexican pesos

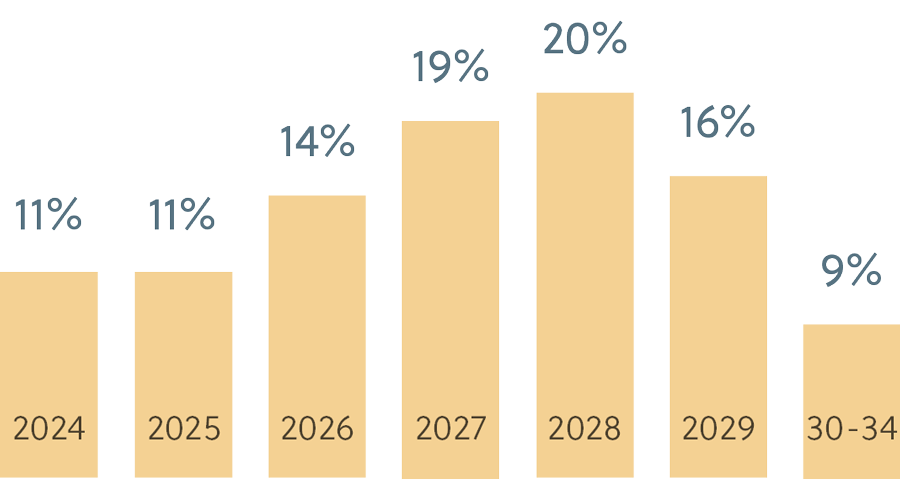

Debt Profile

Dec. 2023