Grupo Lamosa posted growth in its operating results in 2019, as well as a healthy financial structure, which was strengthened during the year by the refinancing of the company’s entire consolidated debt.

During 2019, Grupo Lamosa took timely advantage of windows in the financial markets to refinance its entire debt, through three different schemes: a “Club Deal” syndicated loan with the participation of six banks, a loan from Bancomext (a Mexican state-owned development bank) and an issue of bonds (Certificados Bursátiles) through the Mexican Stock Exchange.

The refinancing involved accessing debt markets, both public and private, as well as development banks, enabling a diversification of financing sources, significantly improving the company’s debt maturity profile and optimizing the financial cost.

Grupo Lamosa maintained its cash flow generating capacity in 2019, which allowed it to continue fulfilling its operational and financial obligations. During the year, capital expenditures totaled $540 million pesos, mainly to support the company’s production operations and for information technologies focused on strengthening operations in South America.

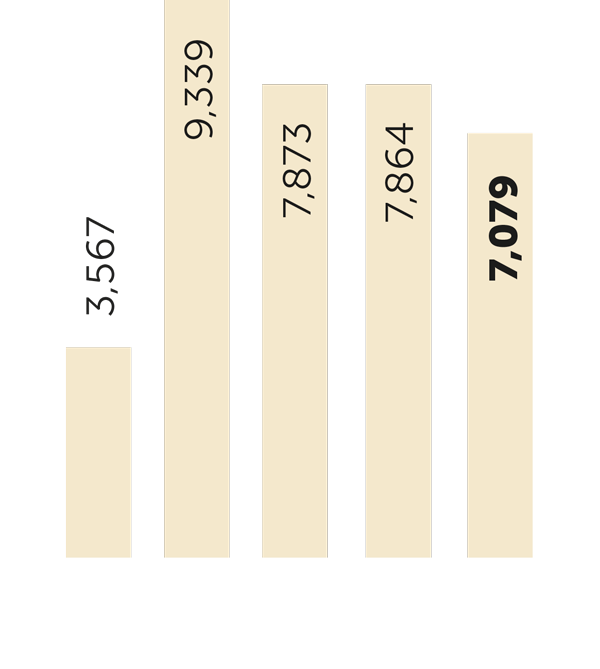

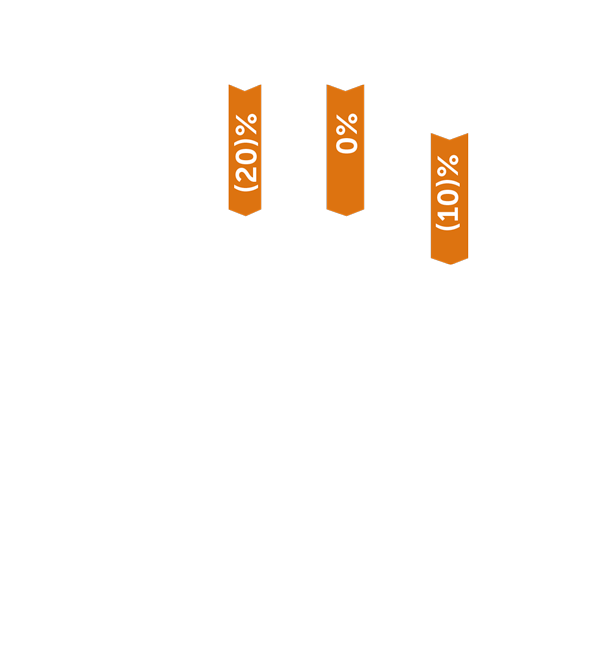

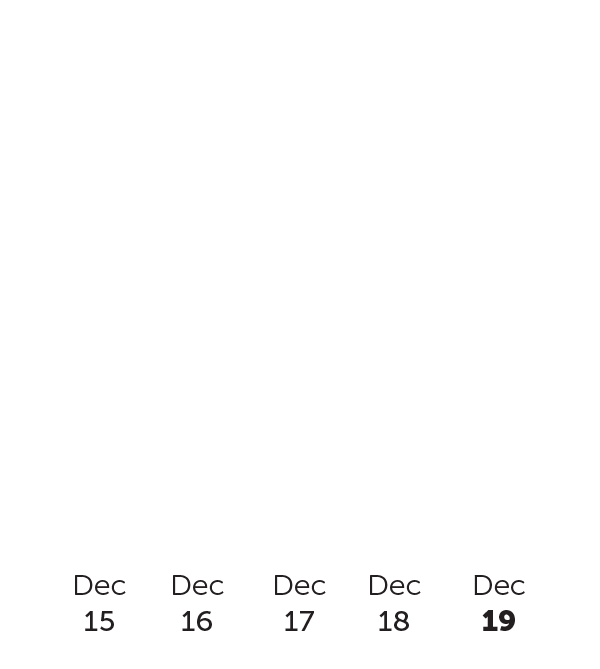

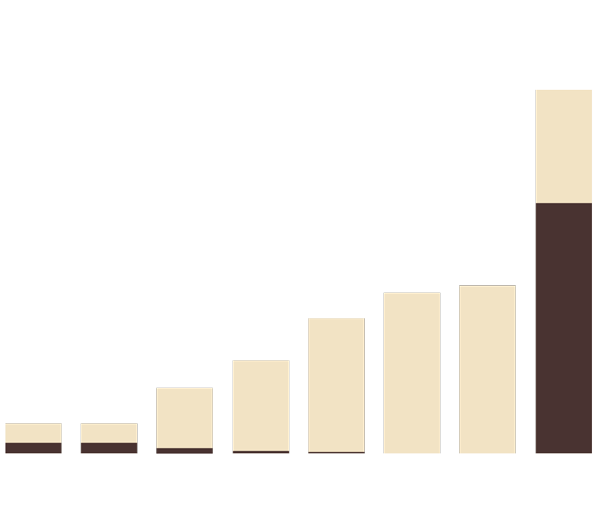

The company’s net debt fell a significant 10% year-over-year, to a balance of $7,079 million pesos as of December 31st, 2019, compared to the net debt of $7,864 million pesos posted at yearend 2018. The ratio of net debt to EBITDA was 2.0 times at the close of 2019, comparing favorably to the ratio of 2.4 times of the previous year.

During 2019, Grupo Lamosa repurchased a total of 1,980,220 shares representing its capital stock, ending the year with a total of 5,064,307 treasury shares.

In order to continue offering investors coverage, the company continued to take part in the Mexican Stock Exchange’s Independent Analyst Program in 2019.

NET DEBT

Millions of pesos

![]() Net Debt/EBITDA

Net Debt/EBITDA

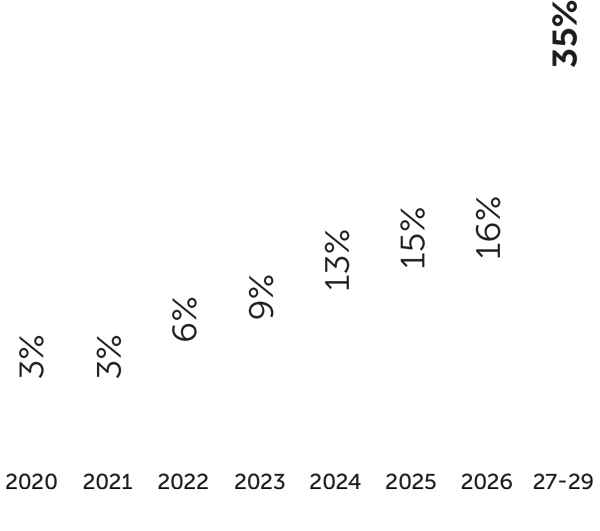

DEBT PROFILE

Dec. 2019

![]() FOREIGN CURRENCY

FOREIGN CURRENCY

![]() PESOS

PESOS