FINANCIAL

PERFORMANCE

Grupo Lamosa’s robust financial structure and increasing earnings permitted investments close to $1,000 million pesos in 2015 as part of one of the most aggressive growth plans implemented since the crisis of 2008.

During the year, the impact of the approximately 17% devaluation of the Mexican peso vis-à-vis the U.S. dollar was minimized because Grupo Lamosa had refinanced its debt at the end of 2014, significantly reducing its dollar exposure.

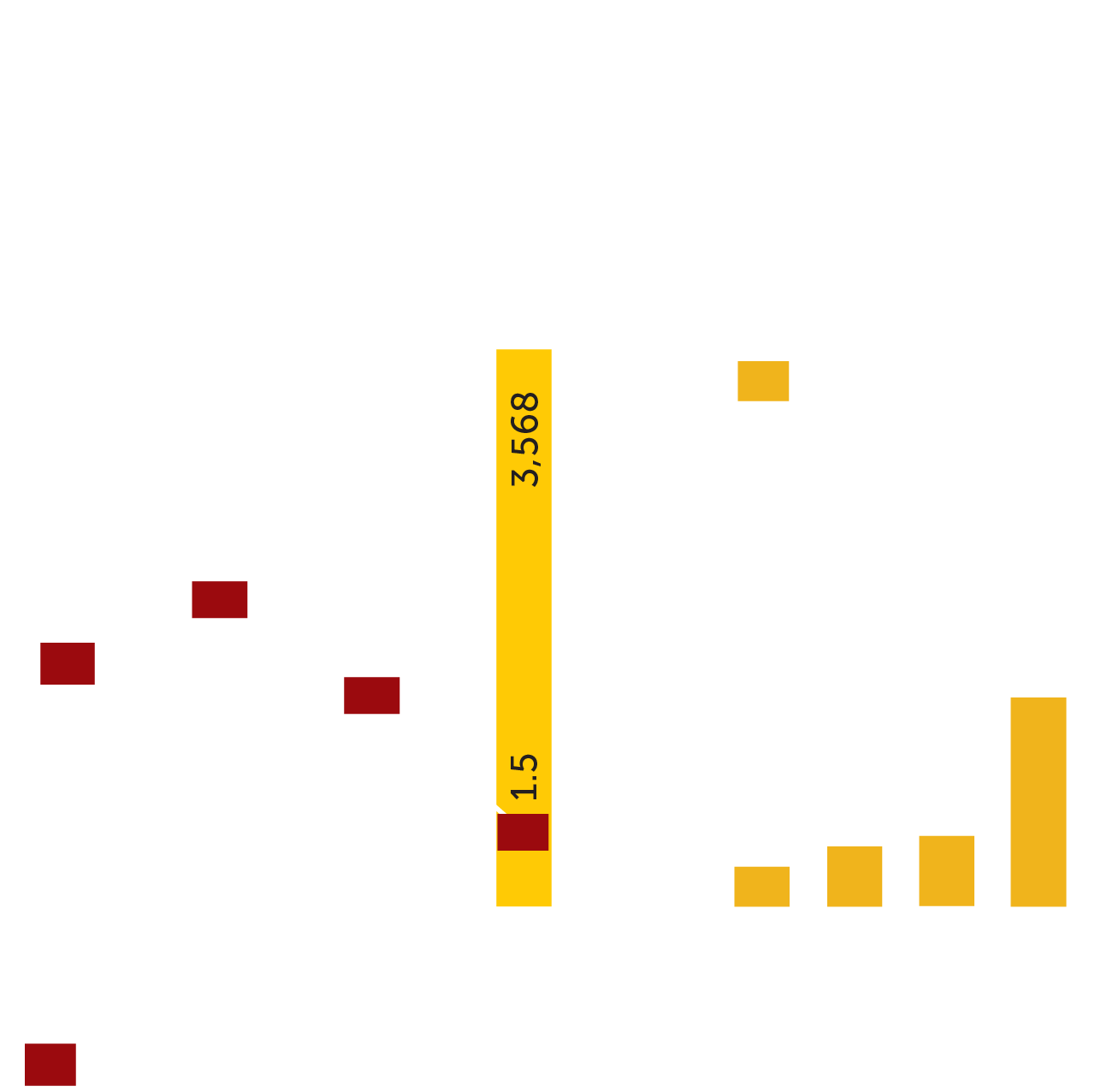

Debt at the close of 2015 was $4,939 million pesos, a year-over-year growth of only 4%. This appropriate debt management, combined with the company’s cash flow generation, allowed it to reduce leverage considerably, from a net debt to EBITDA ratio of 2.2 times as of yearend 2014 to 1.5 times as of the close of 2015.

Grupo Lamosa decreed dividend payments in cash and shares for the third consecutive year.

In 2015, Grupo Lamosa once again took part in the Mexican Stock Exchange’s Independent Analyst Program, maintaining analyst coverage of the company and thereby benefitting current and potential investors in Mexico and abroad.

During the year, the company made no transactions with the shares representing its capital stock.